The Green Dream

The Green Dream

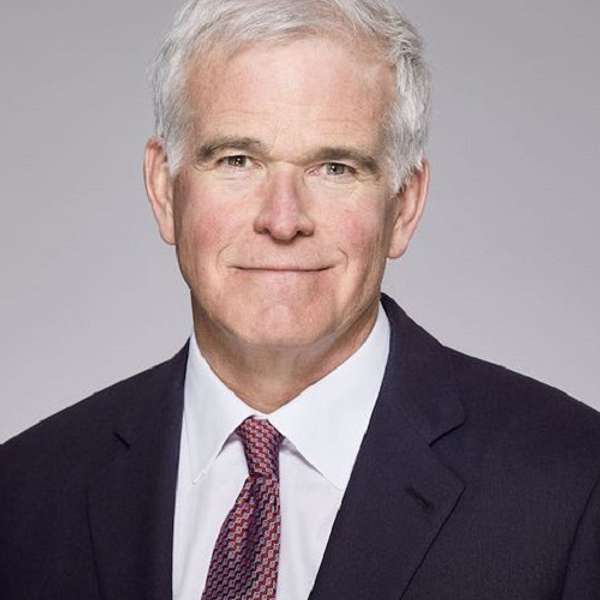

Blood & Gore: Determined to create a more sustainable future - David Blood of Generation IM

David Blood is considered by many to be one of the pioneers of sustainable investment management. Almost 20 years ago in 2004, David created Generation Investment Management alongside Al Gore, the former Vice President of the United States, and they now manage around $43bn USD.

We don’t normally talk about performance on this podcast, but I will make an exception for this fund. Since inception of the Generation Global Share Fund in October 2007, 15 and a half years, the fund has returned 9.9% pa, almost 3% better than the benchmark, which has returned 7.05%. This is an important example - don’t let anyone tell you that active managers can’t beat the index, let alone sustainability funds!

Note that this is a slightly different format to our usual interviews (thus the slightly longer intro!). It’s from a presentation that David gave in Sydney, titled ‘Sustainable investing (done right) is capitalism at its best’. Firstly, David gives an autobiographical intro for about 15 minutes. He talks about his unexpected pathway into finance, corporate culture, and the fact that all businesses create impact - and it’s critical that we measure that impact. This is an important point, because Generation doesn’t like to label what they do as ethical ESG, or impact investing per se – instead they consider a company’s overall impact, and measure it to get a feel for the positive outcomes they can generate. He acknowledges that they compete against mainstream funds – but they are focused on investing sustainability, and being advocates for sustainability. The second half of the discussion is David being interviewed by Julia Harley, an Ethical Adviser’s Co-op Adviser with a firm called Ethinvest in Sydney, and the MC Graham Rich.

David points out that on the current trajectory, we will miss all 17 of the UN SDG targets, as well as the attempt to limit global warming to 1.5c. He highlights the need for urgent change and the fact that we can’t rely on governments to do it. Generation invests with the mission to seek transformational change to drive to a net zero, prosperous, equitable, healthy and safe society. They wants us to change the way we think about capital – we need to put a price on impacts inlcuding emissions, pollution, and so on.

Previously, David spent 18 years at Goldman Sachs including serving as CEO of Goldman Sachs Asset Management. David received a BA from Hamilton College and an MBA from Harvard Business School.

Finally, I’d like to explain two terms that David refers to:

- ‘Alpha’ is the excess return of an investment relative to the return of a benchmark index.

- Fiduciary Duty is the concept that those who manage other people's money act in their beneficiaries' interests, rather than serving their own interests (David discusses the idea that ‘Not considering sustainability means that you are not fullfilling your fiduciary duty – this is a key issue that many of Australia’s largest Super funds have been struggling with in recent years’)

I hope you enjoy this presentation by David Blood. For more information about Generation see: generationim.com

For more information about James Baird, JustInvest Financial Planning and Ethical Investment Advisers see: justinvest and ethicalinvestment.

We wish to acknowledge the traditional custodians of the land we recorded on, the Wardandi Noongar people. We pay our respects to them and their culture; and to elders past, present and emerging.